Economic Relief Legislation

Courtenay D. Mercer, PP, AICP

Executive Director, Downtown New Jersey

March 27, 2020

Downtown New Jersey is providing a series of virtual opportunities for downtown managers, economic development professionals, and public officials to exchange ideas about best practices related to downtown economic development in light of the COVID-19 crisis.

At our second exchange on Friday, March 27, 2020, we were joined by Christina Fuentes, Director of Small Business Services at NJEDA and Erika Calderon, Small Business Legislative Aid from Senator Menendez’s office to discuss programs, policies, and legislation that have passed or are being considered to provide economic relief to downtowns and small business. Video of the full exchange can be accessed at this link, and below is a summary of the main points from the discussion.

New Jersey Programs

Christina Fuentes, Director of Small Business Services at the New Jersey Economic Development Authority (NJEDA) provided an overview of their programs to assist NJ’s businesses, including a grant program for small businesses, a zero percent interest loan program for mid-size companies, support for private-sector lenders and Community Development Financial Institutions (CDFIs), funding for entrepreneurs, and a variety of resources providing technical support and marketplace information.

- FAQs about all programs can be found at: business.nj.gov

- NJEDA also set up an “Eligibility Wizard” at: business.nj.gov

- NJEDA Economic Relief Package Powerpoint

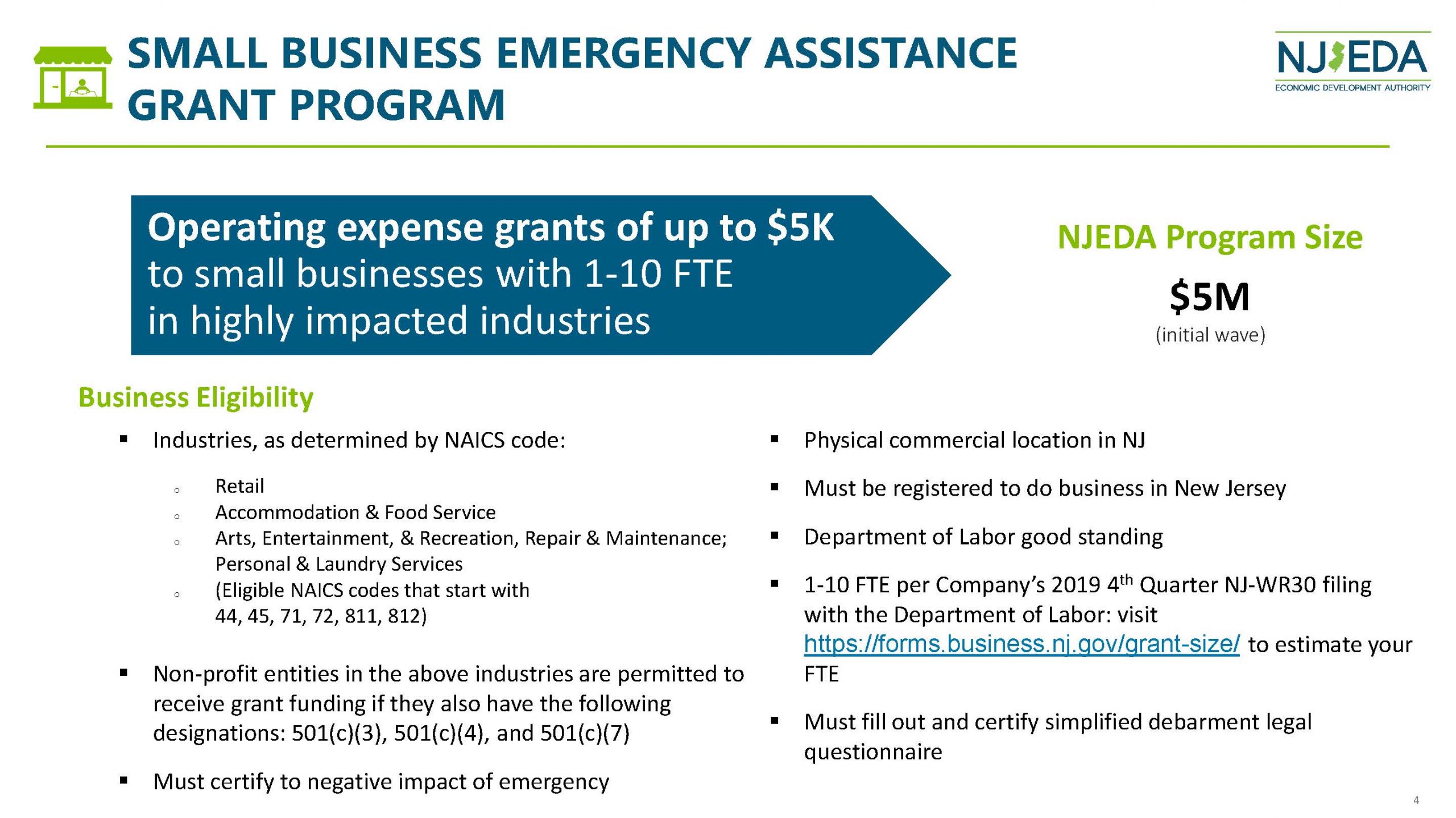

Small Business Emergency Assistance Grant Program:

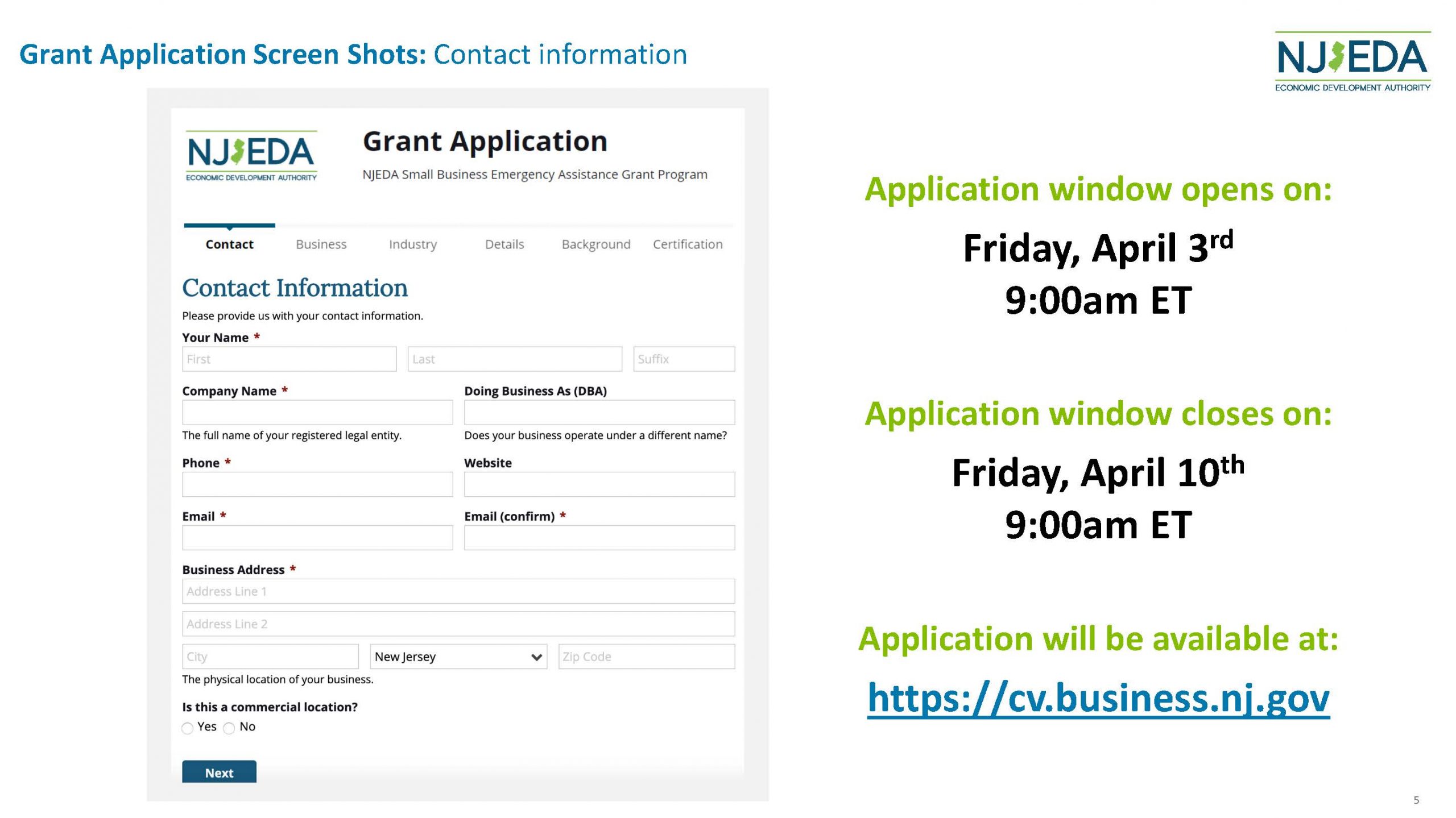

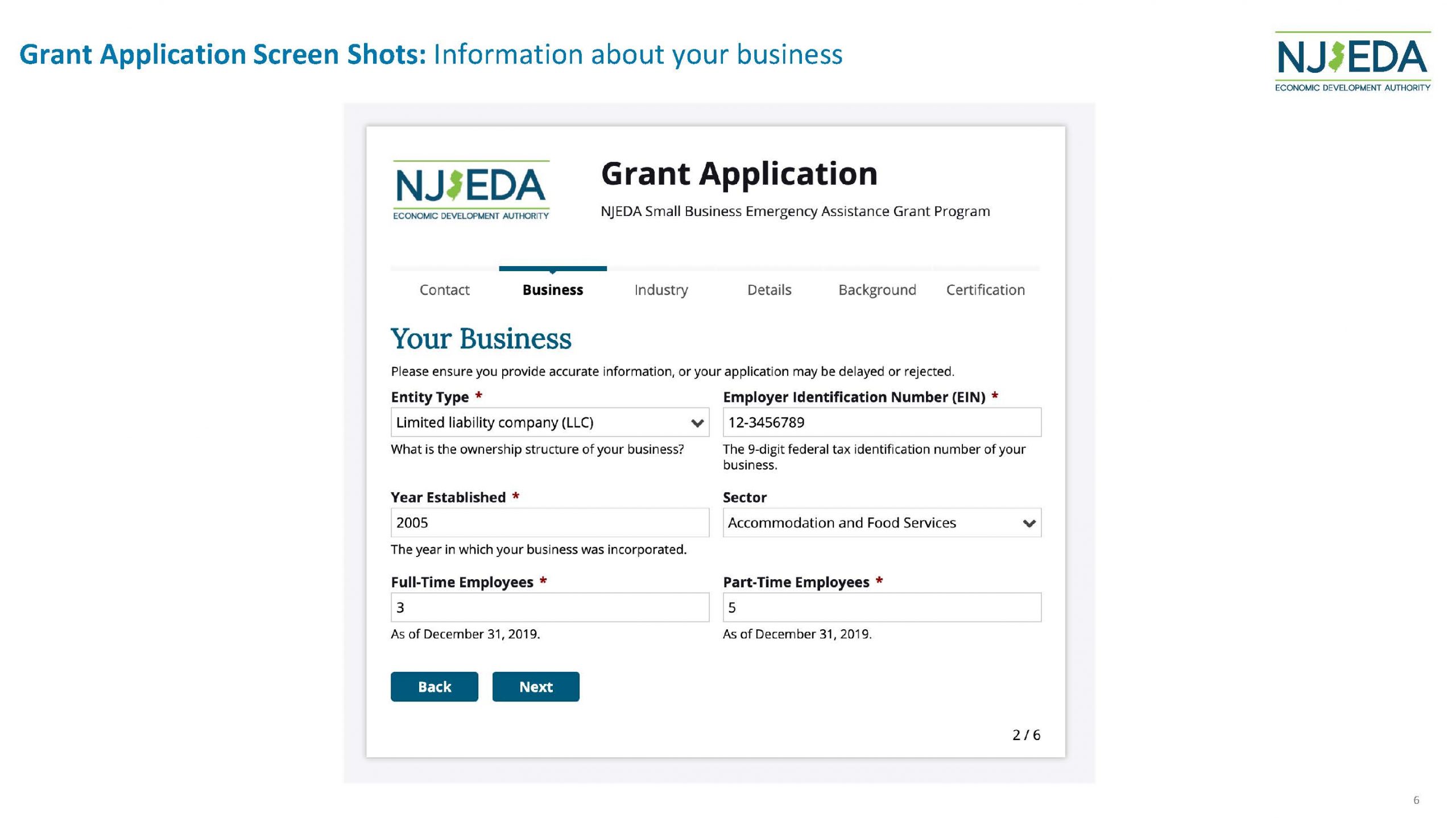

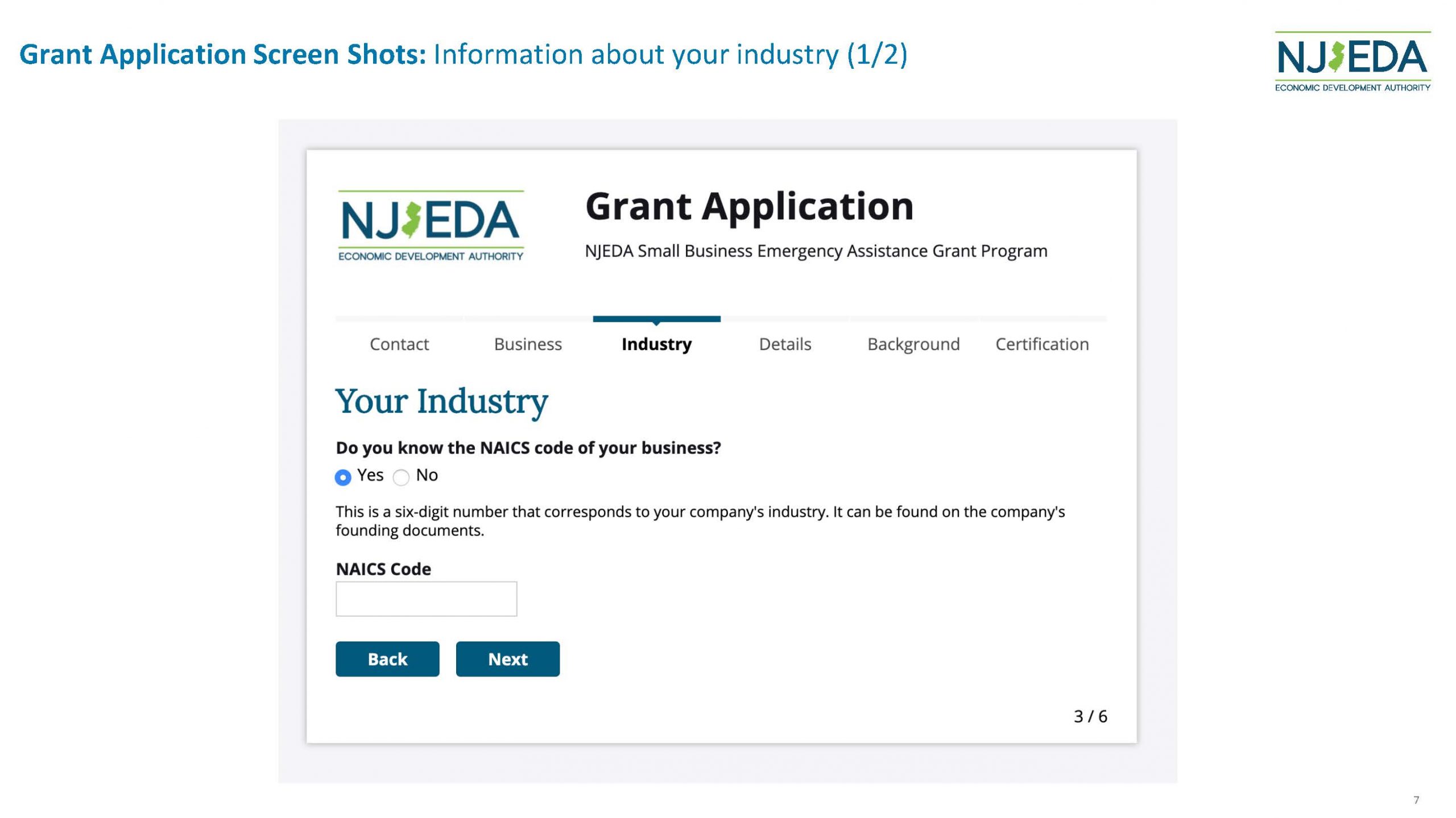

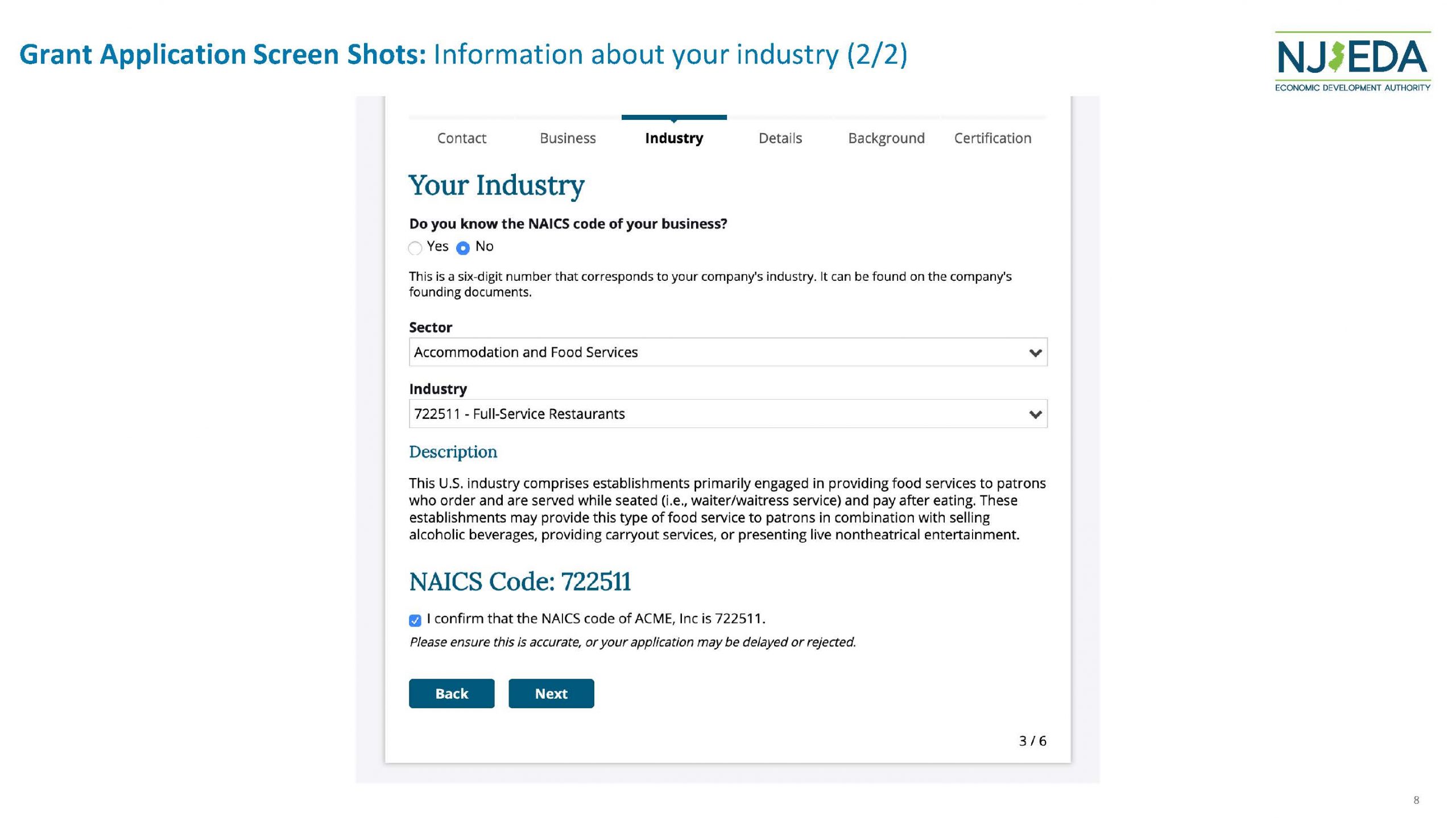

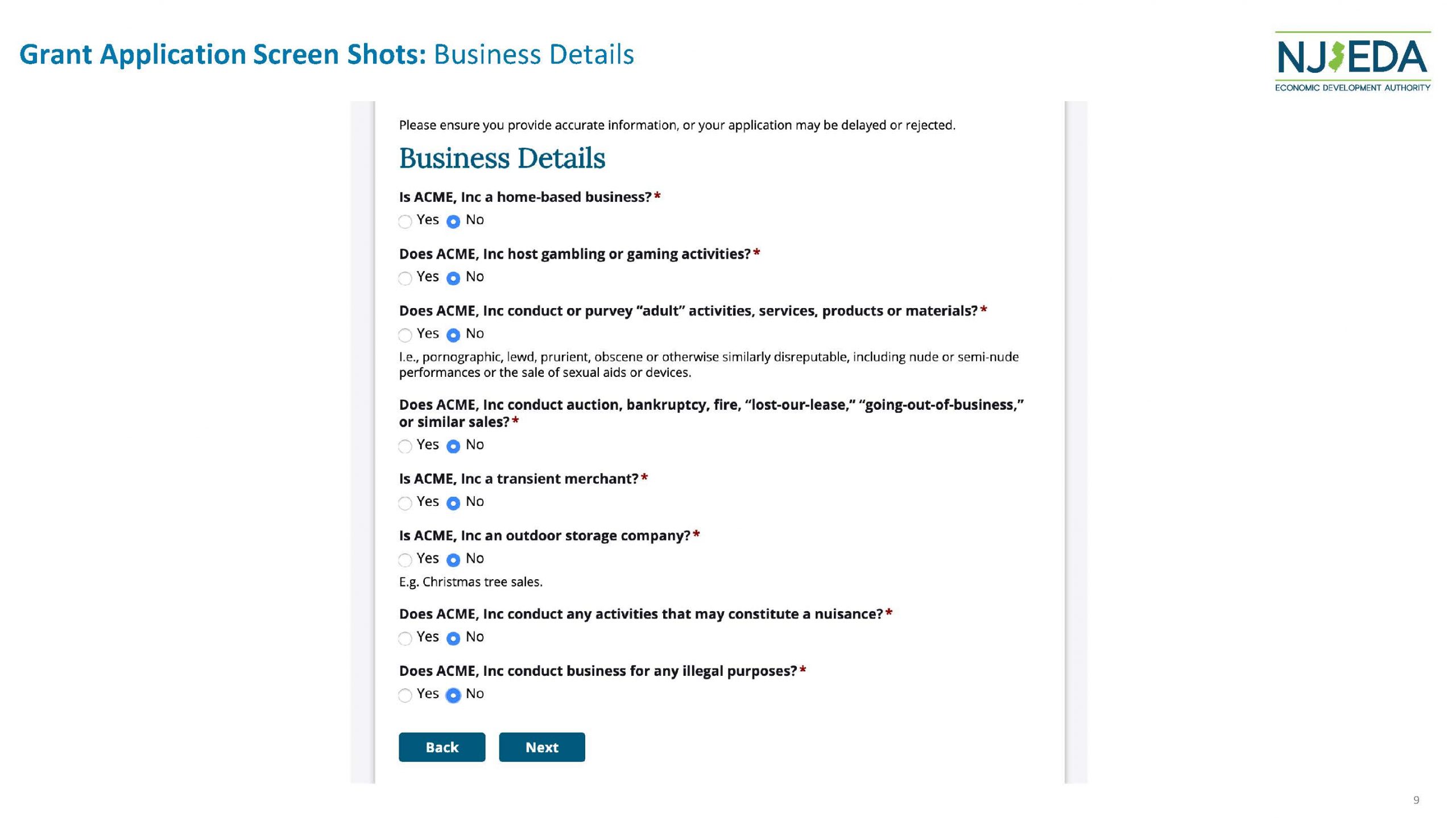

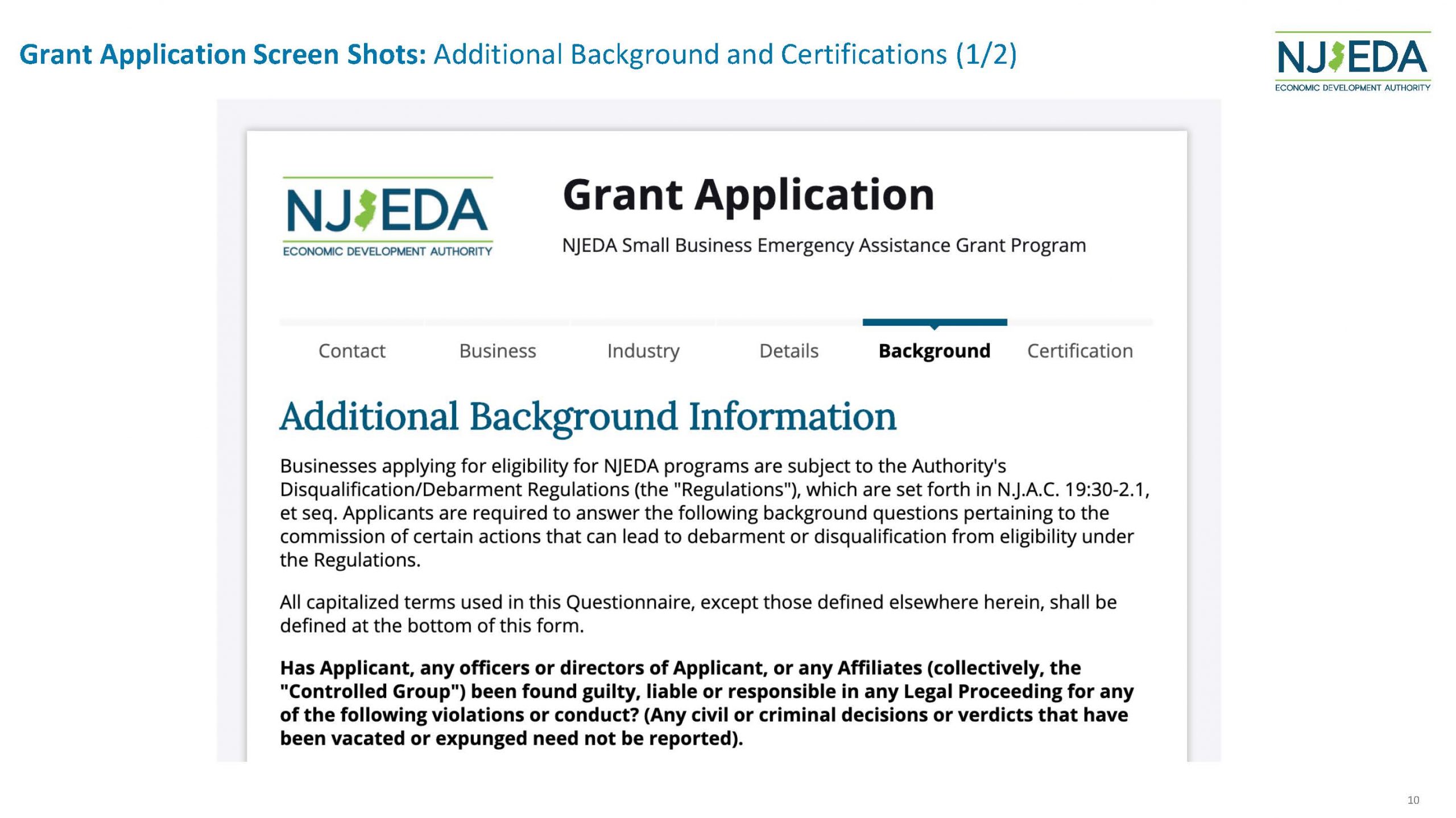

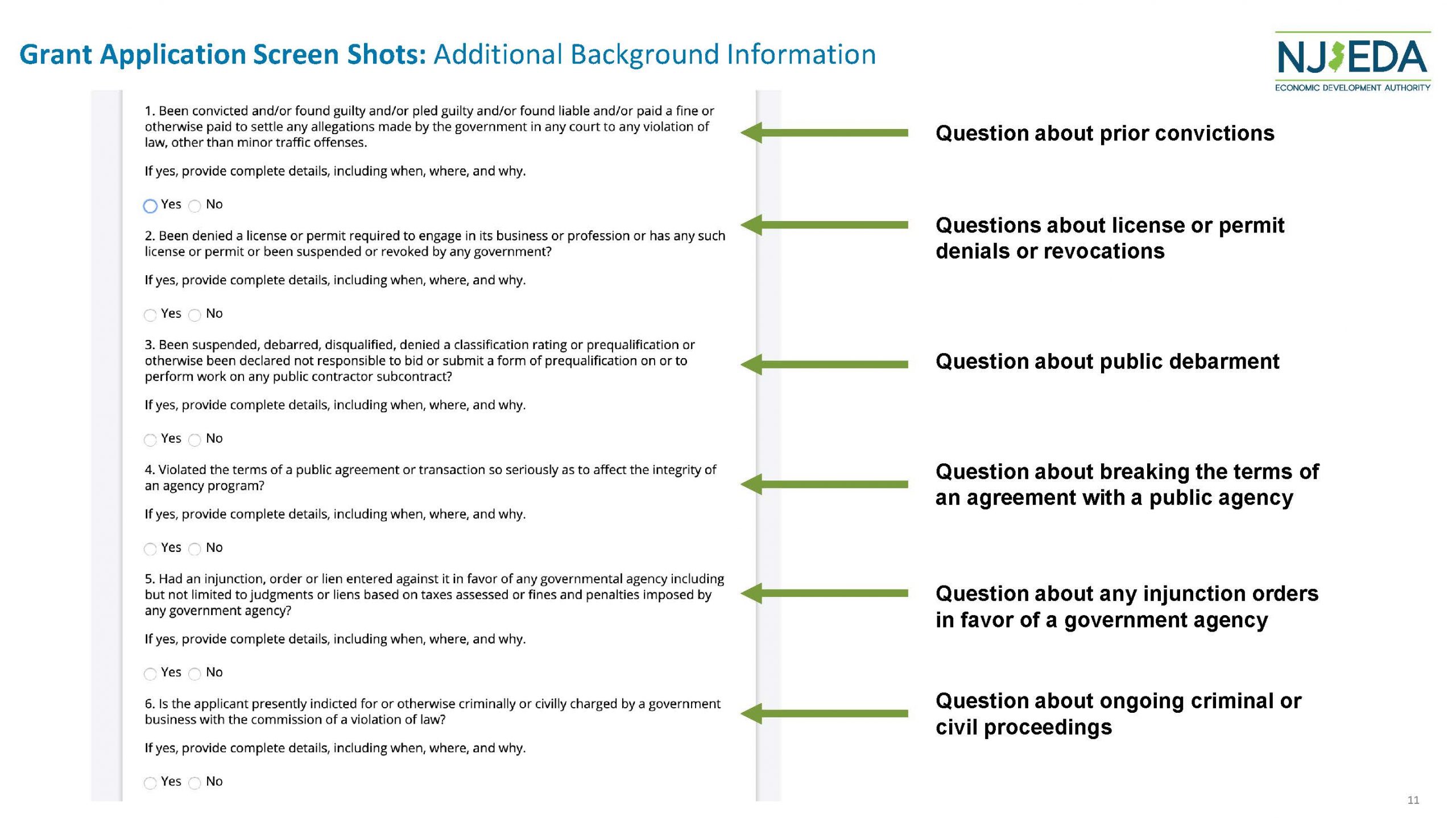

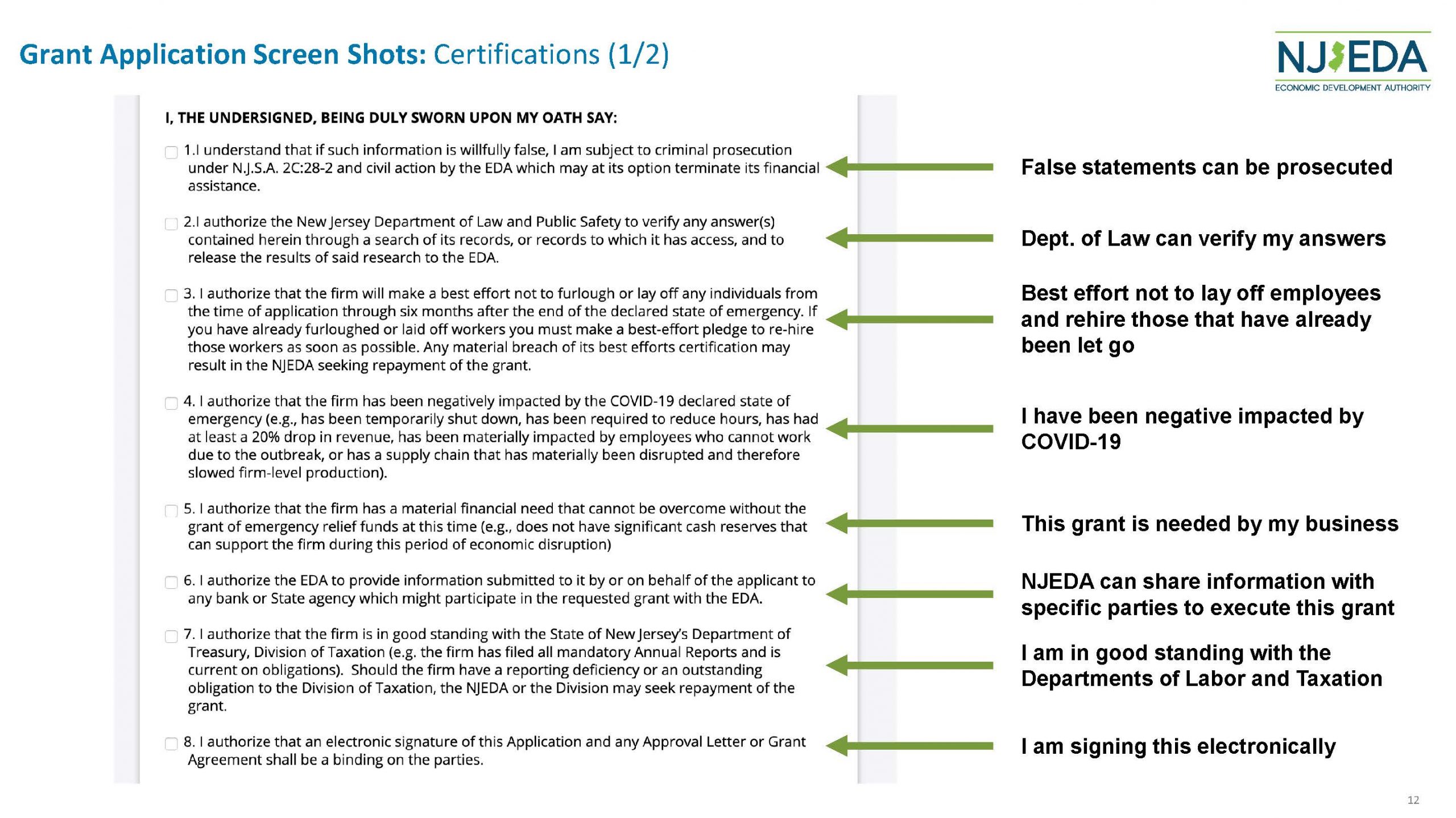

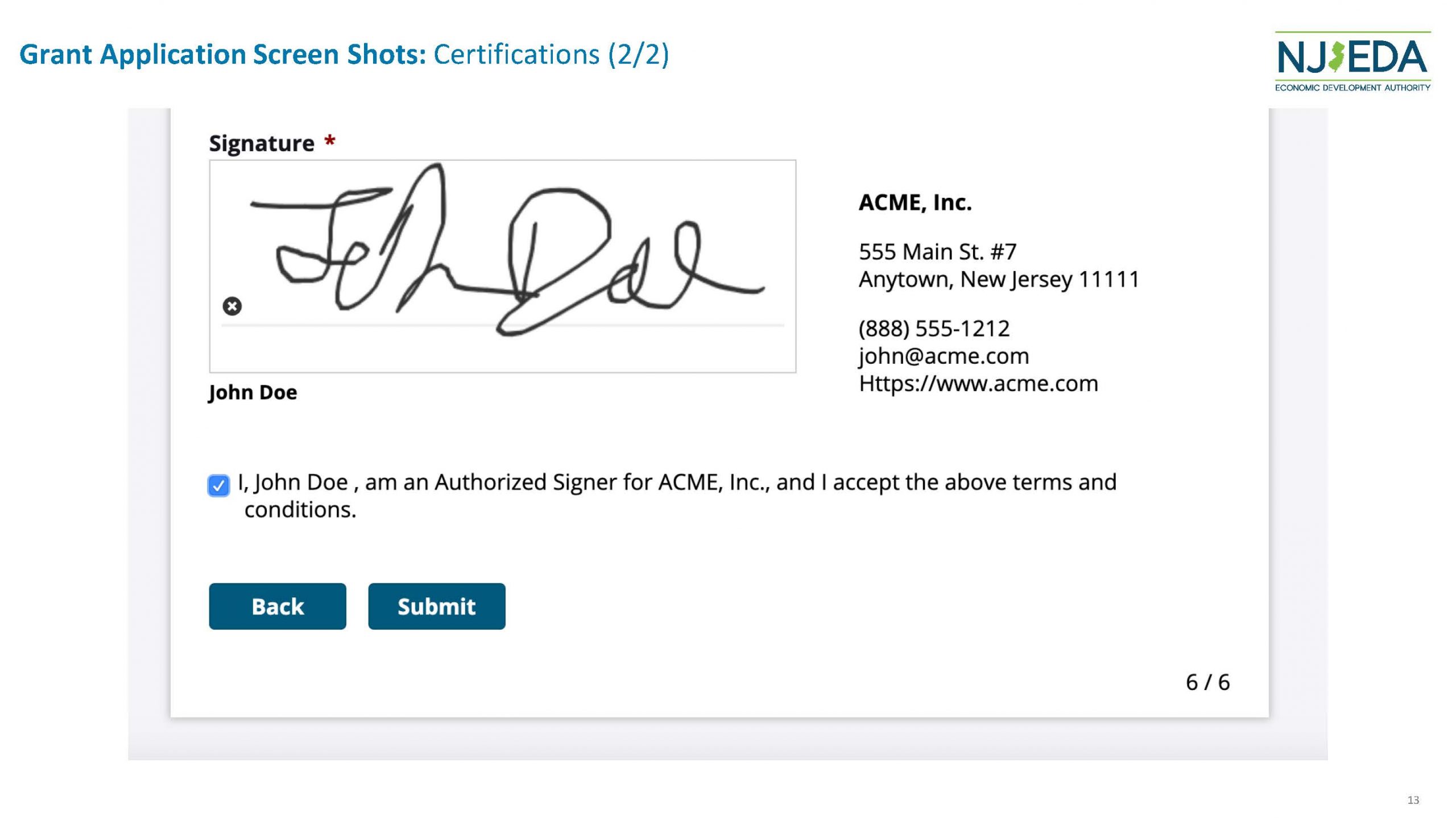

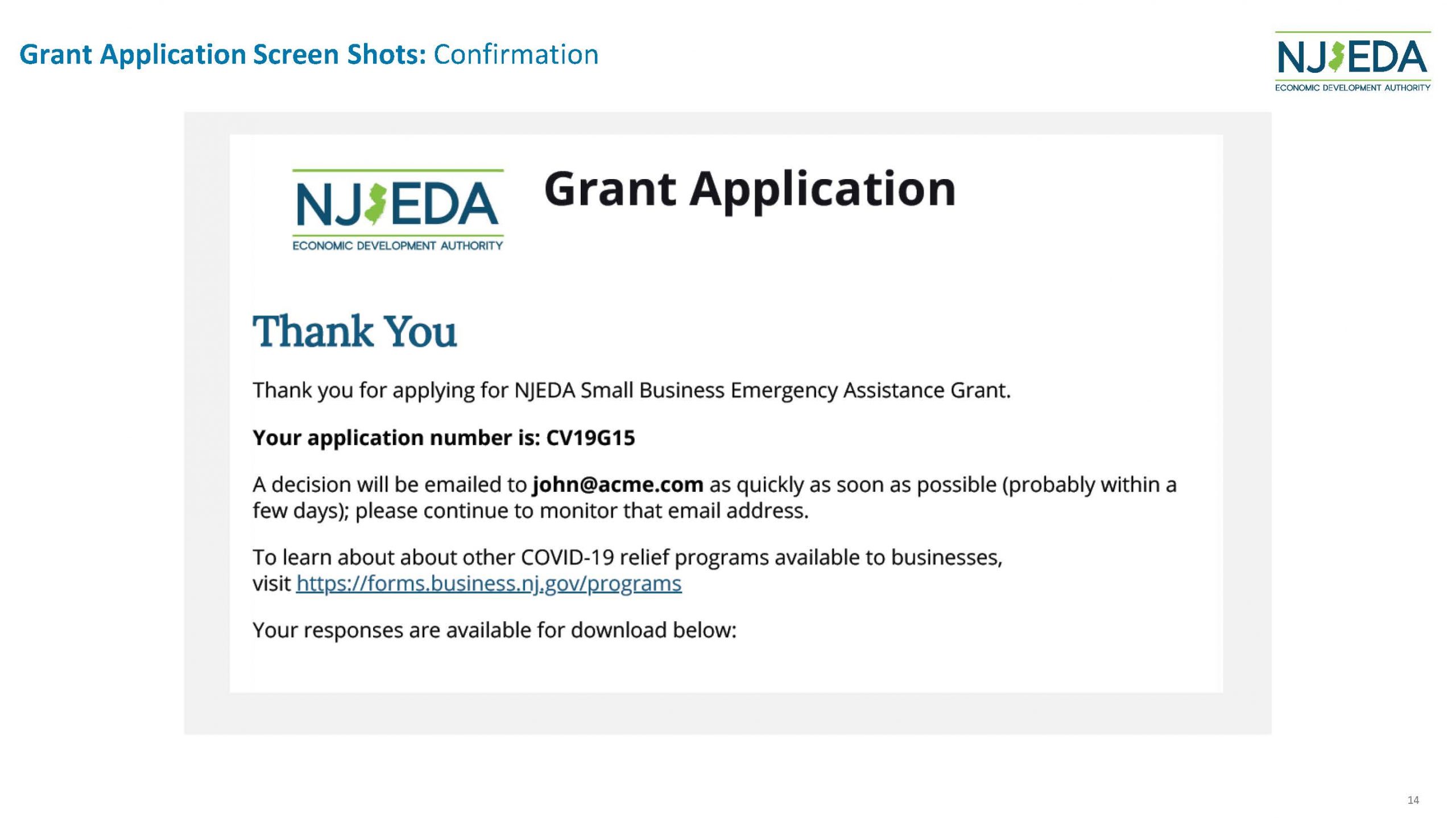

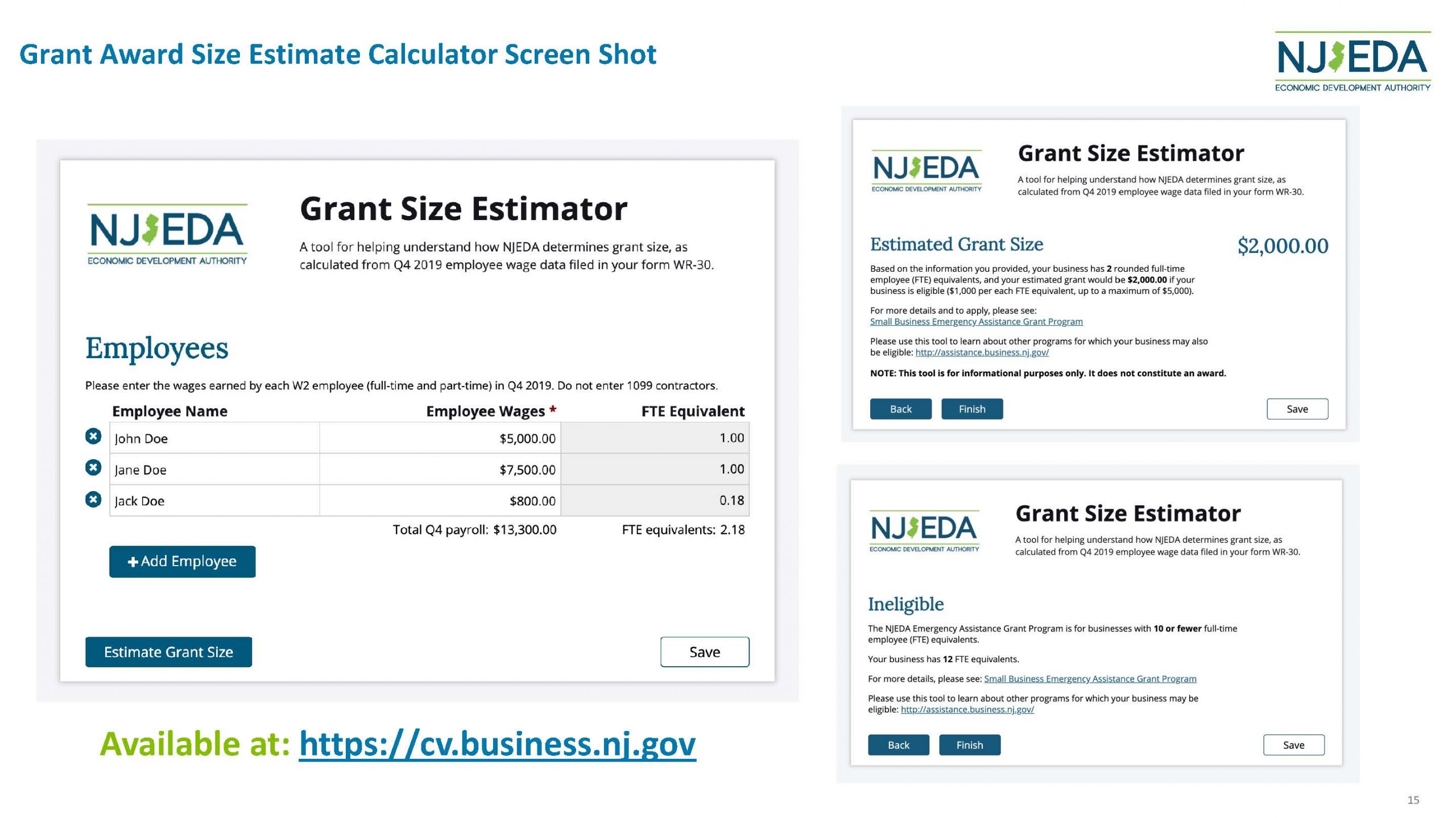

This $5 million program will provide grants up to $5,000 to small businesses. The program is limited to businesses with 1 to 10 fulltime employees (1099 workers do not qualify). The business must be registered in NJ and have physical location here (home-based businesses do not qualify). Non-profits are eligible. Qualifying business type is by NAICS code, including retail (codes starting with 44 or 45); accommodation & food services (codes starting with 72); arts, entertainment & recreation (codes starting with 71); other services (codes starting with 811 and 812). This is a self-certification program, meaning that businesses must certify, but does not need to provide paperwork to prove “need”. An agreement to retain employees is part of the self-certification. Application window opens April 3 and closes April 10. Applications available at cv.business.nj.gov

Small Business Emergency Assistance Loan Program:

This $10 million program that will provide short-term working capital loans of up to $100,000 to businesses. Loans will have ten-year terms with zero percent for the first five years, and then will reset to the EDA’s prevailing floor rate (capped at 3.00%) for the remaining five years. The business must have a physical location in NJ, less than $5 million in revenues, and have been in existence for at least 1 year. To be eligible for the loan, the business must demonstrate negative impact from COVID-19.

Community Development Finance Institution (CDFI) Programs:

- CDFI Emergency Loan Loss Reserve Fund: This $10 million reserve fund provides backing to CDFI loans in case of default, thus enabling the CDFIs to provide more loans at lower interest rates. These loans provide working capital to micro and small businesses of up to $75,000 at interest rates lower than 3.75% for a term not to exceed 5 year. The loans can include flexible repayment provisions (e.g. deferred, interest only, etc.)

- Emergency Assistance Grant Program: This $1.25 million fund provides each CDFI with up to $250,000 to 1) scale-up to provide support to small businesses, and 2) allow CDFIs to buy down interest rates to support the Emergency Loan Loss Reserve Fund (described above).

- Community Development Finance Institutions include: United Counties (Union County) Development Corp. (UCEDC), Greater Newark Enterprises Corp. (GNEC), Regional Business Assistance Corp. (RBAC), New Jersey Community Loan Fund (aka New Jersey Community Capital – NJCC), Cooperative Business Assistance Corp. (CBAC)

Loan Guarantee Programs (for banks and other investors):

- NJ Entrepreneur Support Program: This $5 million program encourages continued capital flows to new companies by providing 80 percent loan guarantees up to $200,000 for working capital loans to entrepreneurs. Eligible companies must be headquartered in NJ, with less than 25 employees (at least 50% of whom are in NJ), and have under $5 million in revenue. The company must be in one of the following sectors: advanced manufacturing, information/technology, life sciences, finance and insurance, clean energy, food and beverage, advanced transportation, food and beverage, film and digital media.

- Small Business Emergency Assistance Guarantee Program: This $10 million program provides 50 percent guarantees on working capital loans and waive fees on loans made through institutions participating in the NJEDA’s existing Premier Lender or Premier CDFI programs. Businesses must have a physical location in NJ, have been in existence for at least one year, have less than $5 million in revenue, demonstrate negative impact from COVID-19, and certify effort to retain employees.

In addition, the NJEDA provided financial support to the following organizations to provide technical support to businesses applying for federal assistance from Small Business Administration (SBA) programs: African American Chamber of Commerce of New Jersey (AACCNJ), New Jersey State Veterans Chamber of Commerce, Rising Tide Capital, Statewide Hispanic Chamber of Commerce of New Jersey (SHCCNJ). Assistance includes, preparing financial information, packaging application documentation, and completing and submitting the on-line or paper-based application.

Some clarifications and questions about NJEDA funding that came out of the discussion with Forum participants:

- These NJEDA programs are first come, first serve. Program funding is capped, so applying early is encouraged.

- Non-profits are eligible for funding.

- Businesses may apply for multiple programs.

- The NJEDA is eligible to take donations from foundations, anchor institutions, banks, etc. to expand grant making capabilities.

- While a business can apply to both NJEDA and SBA for loans, the receipt of a loan from one will be recognized as capital for another. If apply for both, can always turn down a portion or all of one.

Federal Programs

Erika Calderon, Small Business Legislative Aid from Senator Menendez’s office provided an overview of the Coronavirus Aid, Relief, and Economic Security (CARES) Act, which passed into law on March 27, 2020. The legislation establishes programs to provide assistance to small business and private non-profits. Below is a summary of the major programs and initiatives. A more detailed guide from the US Senate Committee on Small Business & Entrepreneurship can be found at: www.downtownnj.com/cares-act-guide

Paycheck Protection Program:

This Small Business Administration (SBA) program provides guaranteed loans to employers that maintain payroll through the COVID-19 emergency. The loans are available to organizations that existed as of February 15, 2020 with fewer than 500 employees. The SBA will forgive the portions of the loan used for payroll costs (for employees with compensation under $100,000), health benefits, rent, mortgage interest payments, utilities, and interest on debt occurred prior to the covered period. Any remaining loan amount not eligible to be forgiven can be carried forward at a maximum 4 percent interest rate for a maximum of 10 years with the first 6 months of payments deferred. The maximum loan amount is $10 million. (Small businesses may apply for both the Paycheck Protection Program and the Economic Injury Disaster Loan, but may not use the resources for the same expenses.) Small businesses and sole proprietorships can apply starting April 3. Independent contractors and self-employed individuals can apply starting April 10.

Small Business Debt Relief Program:

For existing SBA 7(a), 504 and microloan holders, the SBA will cover all loan payments on these loans for 6 months, including principal, interest, and fees.

Emergency Economic Injury Grant:

These grants provide an emergency advance payment up to $10,000 to small businesses and private non-profits within three days of applying for an SBA Economic Injury Disaster Loan (EIDL). This advance does not need to be paid back under any circumstance, and may be used to keep employees on payroll, to pay for sick leave, meet increased production costs due to supply chain disruptions, or pay business obligations, including debts, rent and mortgage payments. Small businesses in existence as of January 31, 2020 with 500 or fewer employees are eligible for EIDL, including sole proprietorships, independent contractors, and cooperatives and employee owned businesses. Most private non-profits of any size are also eligible. (Small businesses may apply for both the Paycheck Protection Program and the Economic Injury Disaster Loan, but may not use the resources for the same expenses.) Applications are being accepted now. Contact an SBA resource partner for assistance (list below).

Counseling & Training:

SBA’s resource partners will receive additional funds to expand their reach and better support small business owners with counseling and up-to-date information regarding COVID-19. These resource partners include local Small Business Development Centers (SBDC), Women’s Business Centers (WBC), or SCORE mentorship chapters. To find a local resource partner, visit sba.gov/local-assistance/find. In addition, NJEDA has provided funds to the African American Chamber of Commerce of New Jersey (AACCNJ), New Jersey State Veterans Chamber of Commerce, Rising Tide Capital, Statewide Hispanic Chamber of Commerce of New Jersey (SHCCNJ) to provide similar assistance.

General Discussion

In addition to the overviews of the NJEDA and SBA programs, participants in the Forum discussed best practices and desired assistance for downtowns and small businesses.

- There is still clarity needed with regard to what businesses can remain open for take-out and delivery services. Can a retailer (e.g. book store, boutique, etc.) remain open if they offer pick up/delivery?

- It was noted that non-profit SIDs/BIDs are eligible for the NJEDA grant program. The general consensus, however, was that SIDs/BIDs should not compete with their small businesses for limited resources. Instead, BIDs need to continue to demonstrate their value to their members and the municipality through this crisis, including ongoing cleaning and maintenance, marketing, assistance to business owners. BIDs are now considering how to reallocate funds within their approved budget to serve their members differently in this time of upheaval, e.g. cancelled event spending to marketing and technical assistance.

- Participants feel that the freeze on evictions and foreclosures should be extended to commercial properties (it currently only applies to residential).

- Some property owners are requesting property tax relief. Municipalities do not have the authority to unilaterally grant the same – it must be authorized by the State legislature.

- There are many instances of crowdfunding support for small businesses:

- Businesses are initiating their own campaigns to support their workers.

- Management of a fund may be difficult from a human resource perspective for many BIDs, they are encouraged to partner with a foundation.

- The Westfield United Fund began a “We Love Local” campaign to support small businesses impacted by the COVID-19 restrictions. The fund matched the first $15,000 of donations, and the Westfield Foundation matched another $30,000.

- Fort Lee BID is using a portion of its budget to purchase gift cards from its restaurants to then give to first responders. This program is for businesses that are still open, willing to deliver, and interested in participating. Gift card purchases are divided equally among those eligible to participate.

- The Springfield Community Partnership is subsidizing a campaign for residents to purchase $25 gift cards for $15.

- Prospect and Ironbound BIDs in Newark are raising money through private contributions to provide seniors and other income qualified residents with vouchers for essential purchases.

- Some BIDs, like Livingston, are already meeting to plan for “what’s next” once the restrictions are lifted.

- DNJ will create a task force to discuss best practices and reinforce the value of BIDs.

The next Downtown Management Forum will be Friday, April 3, 2020 at 11:00AM. Mike Blinder, Founder & President of The Blinder Group, publisher of Editor & Publisher Magazine, and author of Survival Selling Even in the Toughest Times will present his Survival Marketing Workshop. Registration is required, by visiting www.downtownnj.com/downtown-management-forum-covid.

Downtown New Jersey has also created a Resource Page where we are posting important updates related to legislative and policy initiatives in response to COVID 19, as well as resources from peers and experts. For more information, visit www.downtownnj.com/policy-watch-covid.